How to draw up a monthly budget

Table of Contents

Table of Contents

Are you tired of living paycheck to paycheck and not having enough money at the end of the month? One of the most effective ways to get your finances in order is by drawing up a monthly budget. Whether you’re saving for a big purchase, paying off debt, or just want to have more control over your money, a monthly budget can help you reach your financial goals. In this article, we’ll explore how to draw up a monthly budget and why it’s important for your financial well-being.

The Pain Points of Budgeting

Do you find yourself wondering where your money went at the end of the month? Are you constantly stressed about money? Do unexpected expenses leave you scrambling to make ends meet? These are all common pain points related to managing your finances. Drawing up a monthly budget can help alleviate these stressors by giving you a clear picture of your income and expenses each month.

How to Draw Up a Monthly Budget

The first step in drawing up a monthly budget is to track your income and expenses for one month. This includes any income you receive, such as your paycheck, as well as any expenses you have, such as rent, utilities, and groceries. Once you have a clear picture of your income and expenses, you can start creating your budget.

Start by listing all of your income sources and their amounts. Then, list all of your expenses and their amounts. Be sure to include everything, even small expenses like a morning coffee or a magazine subscription. Next, subtract your expenses from your income to see how much money you have left over each month.

If you have money left over, you can allocate it towards savings or debt repayment. If you have more expenses than income, you’ll need to find ways to cut back on your spending. This might mean reducing discretionary spending, like eating out or buying new clothes, or finding ways to increase your income, like taking on a part-time job.

How to Stick to Your Monthly Budget

Creating a budget is one thing, but sticking to it is another. Here are some tips to help you stay on track:

- Set realistic goals. Be honest with yourself about what you can and can’t afford.

- Hold yourself accountable. Track your spending and adjust your budget as needed.

- Be flexible. Unexpected expenses will always crop up, so be prepared to adjust your budget when needed.

- Be consistent. Make budgeting a regular habit, not just a one-time thing.

The Benefits of Drawing Up a Monthly Budget

There are many benefits to drawing up a monthly budget, such as:

- Giving you control over your money

- Helping you save for future expenses

- Reducing financial stress

- Helping you pay off debt faster

Tips for Success

Here are some additional tips to help you succeed at budgeting:

- Use budgeting software or apps to help you track your income and expenses.

- Automate your savings by setting up automatic transfers from your checking account to your savings account.

- Find ways to reduce your expenses, such as by cooking at home instead of eating out.

- Celebrate your successes! When you reach a financial goal, take a moment to acknowledge your accomplishment.

Personal Experience

When I first started budgeting, it was difficult to adjust to tracking my expenses and cutting back on my spending. However, after a few months of budgeting, I noticed a huge difference in my financial situation. I was able to save more money and pay off debt faster. Now, budgeting has become a regular habit and I feel more in control of my finances.

Question and Answer

Q: How often should I review my budget?

A: It’s a good idea to review your budget at least once a month, but you may need to adjust it more often if your income or expenses change.

Q: Should I use a spreadsheet or paper to track my budget?

A: It’s up to you. Some people prefer the convenience of budgeting apps or software, while others prefer the simplicity of a paper budget.

Q: What if I have irregular income?

A: If you have irregular income, it’s still important to track your income and expenses. You may need to be more flexible with your budget and adjust it as your income changes.

Q: What if unexpected expenses come up?

A: Unexpected expenses are a part of life. If you have an emergency fund, you can use it to cover unexpected expenses. If not, you may need to adjust your budget to accommodate the unexpected expense.

Conclusion of How to Draw Up a Monthly Budget

Drawing up a monthly budget can be a powerful tool for improving your financial well-being. By tracking your income and expenses and creating a budget, you can take control of your money and work towards your financial goals. Remember to be realistic with your goals, hold yourself accountable, and celebrate your successes along the way.

Gallery

Lots Of People Draw Up A Budget And Then Fail Spectacularly At Sticking

Photo Credit by: bing.com /

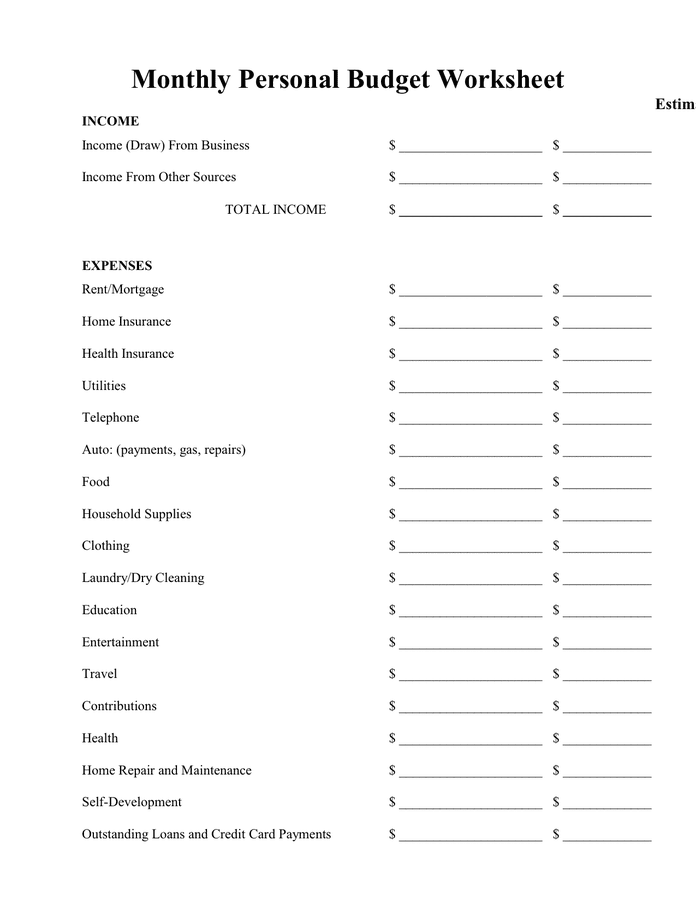

Monthly Personal Budget Worksheet In Word And Pdf Formats

Photo Credit by: bing.com / budget worksheet personal monthly pdf printable income word business draw

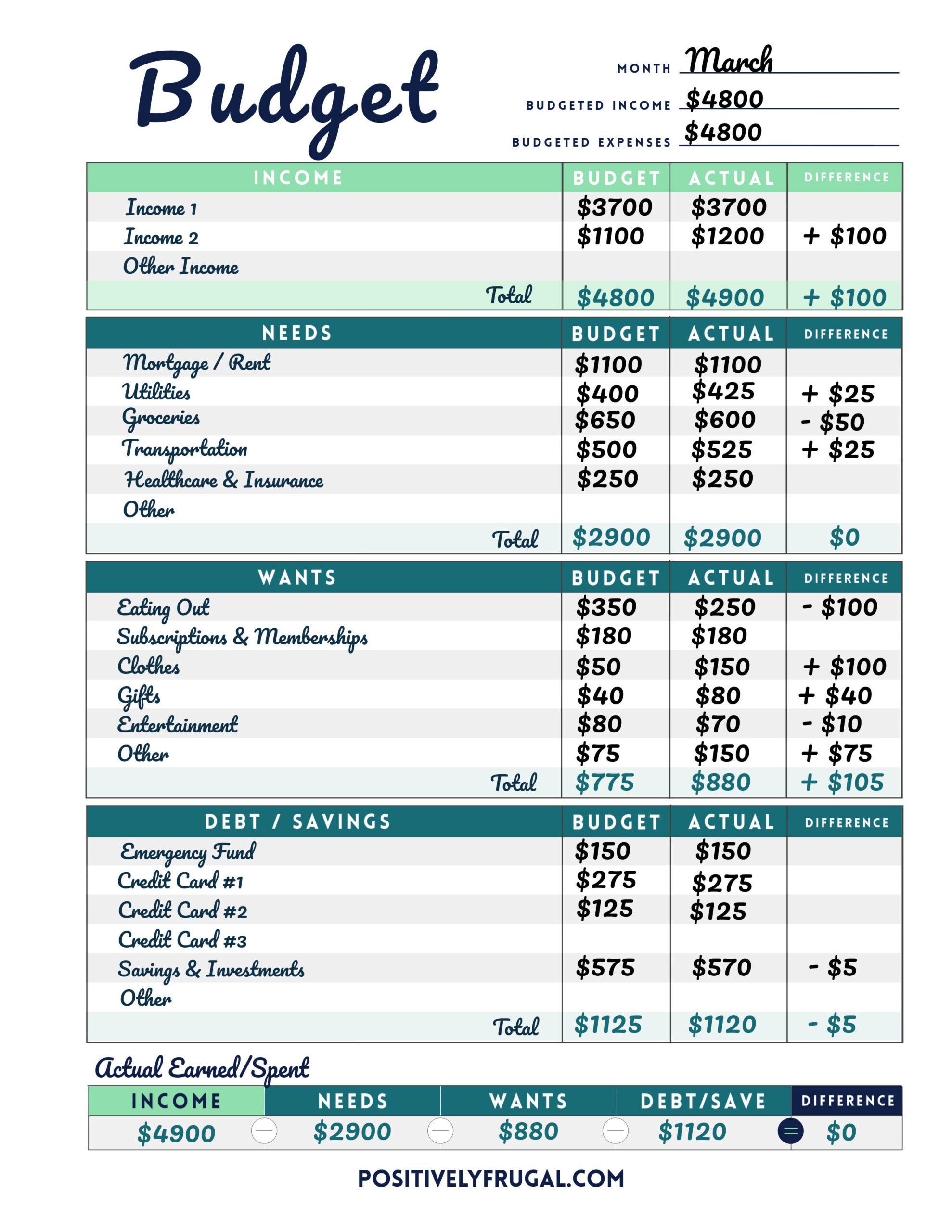

Create A Monthly Budget And Get Out Of Debt!

Photo Credit by: bing.com /

How To Make A Monthly Budget: 3 Easy Steps - Positively Frugal

Photo Credit by: bing.com /

HOW TO DRAW UP A MONTHLY BUDGET - Women Issues

Photo Credit by: bing.com / monthly tebogo